In the past few years, India has quietly become one of the fastest-growing hubs for mergers and acquisitions, as well as investments. The number of local M&A transactions crossed record highs in 2025. The total deal value reached $1.7 billion in H1, a significant growth compared to 2024’s full-year total of $1.1 billion. Such growth is mainly driven by the consolidation in BFSI, tech, and healthcare.

As businesses demand better cloud document management and more sophisticated due diligence software, the virtual data room market has emerged as essential digital infrastructure for modern deal-making.

For CFOs, lawyers, and deal advisors, this change opens an important question: how will virtual data rooms shape India’s next phase of business growth? This VDR market India overview explores how the Indian VDR market is evolving, what drives its rapid adoption, and where the biggest opportunities lie.

Current state of the VDR market in India

There are no current VDR adoption rates for the Indian market, as it still evolves. However, various market researches, such as this one from Grand View Research, point out that in 2025, more Indian companies are moving from ad-hoc document-sharing (email, file-shares) to dedicated secured platforms.

Also, it is estimated that over 80% of Indian businesses involved in M&A now rely on some form of digital solution for due diligence workflows (though this figure doesn’t isolate full VDR deployments).

As the startup ecosystem grows, and with many deals involving high volumes of documentation, the need for efficient and secure document sharing is becoming acute. That means, in the upcoming five years, we’ll witness how Indian businesses enhance data security and document management with virtual data room solutions.

Virtual data room market size & Growth trajectory

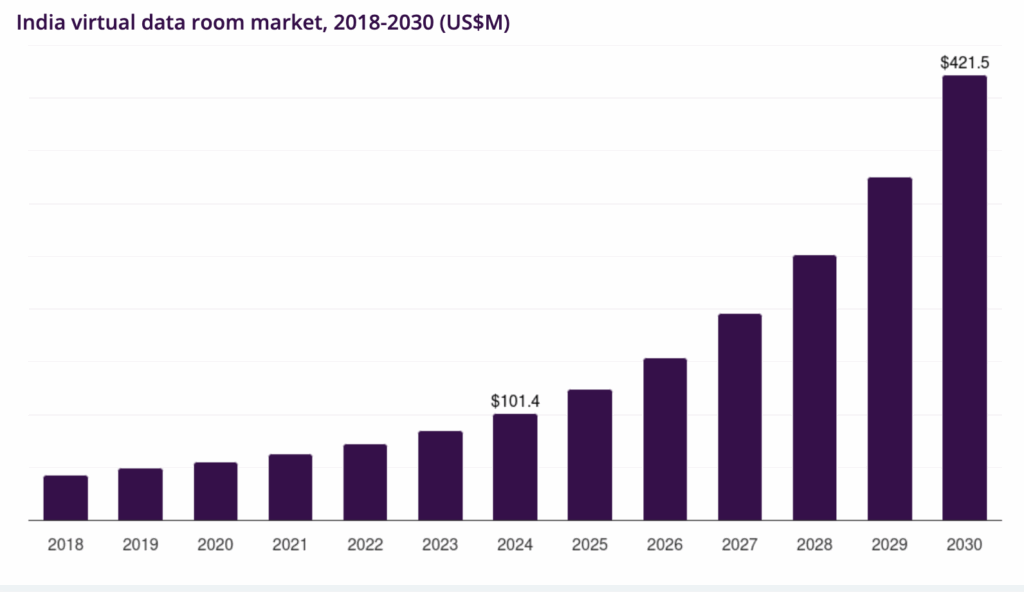

Here’s what recent virtual data room market research shows for the India-specific market:

- The Indian VDR market was valued at $101.5 million in 2024.

- It is projected to grow to $421.5 million by 2030 with a compound annual growth rate (CAGR) of about 27.8% between 2025-2030.

- In 2024, India represented about 4.2% of the global virtual data room market.

These numbers strongly suggest that India is moving into a high-growth phase for VDR adoption.

There are several global virtual data room providers that dominate the VDR landscape and operate (or plan to) in India. Research and Markets report points out names like Intralinks, Datasite, Ideals, and Citrix Systems.

On the local side, there are 100% Indian data room providers, such as Confiex Data Room and Right2Data. These are brand new companies that haven’t got much attention yet, but this is a clear sign that the virtual data room market in India is shaping with some domestic players.

Barriers to VDR adoption & Impact of COVID-19

Despite the evident signs of growth, there are still some obstacles to data room adoption across Indian businesses. The following barriers suggest that market penetration is still in an early-to-mid phase for many segments:

- Awareness and mindset. Many companies still question the need for a dedicated VDR or rely on manual/PDF workflows.

- Cost & IT complexity. Deploying a full VDR (with indexing, user-permissions, access asset documentation, multilanguage support) requires investment. Plus, integration with legacy systems (ERP, CRM, network drives) causes technical hurdles that slow down adoption.

- Infrastructure & cloud readiness. While India’s data-centre and cloud footprint is expanding, not all regions or smaller firms are yet comfortable with cloud-based data rooms.

- Regulatory & compliance uncertainty. India is updating data-protection and disclosure laws, including their Digital Personal Data Protection Act. Some firms delay adoption until legal clarity emerges.

- Perceived security risks. Given the high cost of data breaches, firms hesitate to move large volumes of documents into new platforms.

As for many key companies across the globe, COVID-19 acted as a catalyst for digital transformation in India. This transformation, which included the rapid integration of cloud technologies and remote collaboration tools, pushed the VDR awareness forward.

Firms that had adopted digital transformation back then now experience substantial growth. As dealflows picked up with pent-up demand after 2020, many firms stuck with digital document storage and management tools.

Key VDR adoption growth drivers for 2025-2030

These are several key forces that are going to fuel the growth of the virtual data room market in India in the next five years:

1. Increased M&A activity

India is becoming a major hub for acquisitions and strategic investments. According to the market report, the deal volume for the first eight months of 2025 was about $70 billion. This is higher than the same forecast period in 2024, says the report. And the tech-M&A alone saw 135 deals in H1 2025, with disclosed value already at $1.7 billion.

This surge means more deals (including cross-border transactions) and more documentation, which brings us to the demand for virtual data rooms that can securely host and manage all this content in real time.

Business leaders, especially CFOs and M&A professionals, will increasingly ask: “Can our data-room solution keep up with a rising deal volume and international-quality controls?” That question itself drives adoption.

2. Digital transformation & Government initiatives

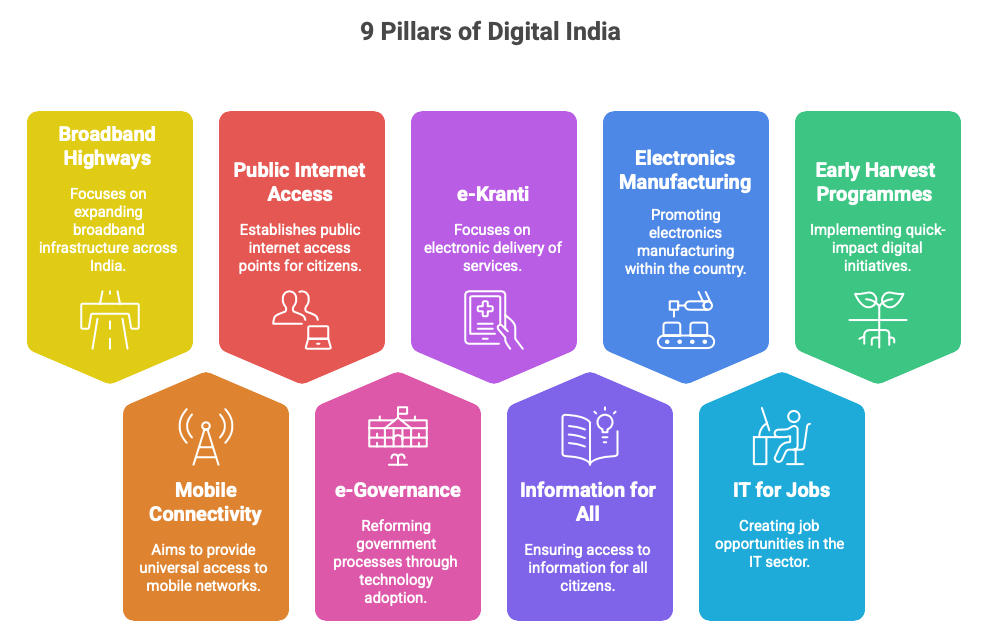

Another factor that will drive the adoption of virtual data room services in India is the abovementioned digital transformation and government initiatives that push it forward.

Particularly, we mean the “Digital India” and “Make in India” programs. These initiatives are set to shift enterprises toward cloud, hybrid work, secure workflows, and other aspects of social life. Here are the key pillars of the Digital India program:

All these changes make transparency and data security more important than ever, and that’s where the best virtual data room solutions come in. Data room platforms become a part of a secure, auditable digital infrastructure for both local deals and international collaboration.

3. Remote work normalization

The 2024 Nasscom report on remote work states that approximately 70% of organizations in the tech industry in India have adopted a hybrid work model. Cities like Jaipur, Kochi, Indore, and Lucknow see an increase in coworking spaces and high-speed internet adoption.

This new way of working creates a need for secure solutions for handling data safely. Deal files, contracts, and other sensitive documents need to be accessed by multiple people in different locations, and companies just can’t rely on physical file rooms or insecure email attachments.

The VDR market in India must adapt to those needs. That means VDR providers should offer features like: secure access, granular permissions, encrypted sharing, and mobile readiness. These functionalities are important for remote-first workflows.

4. Regulatory compliance and data protection

The Indian cybersecurity market is projected to grow from $5.56 billion in 2025 to $12.90 billion in 2030. This growth is driven by the need to comply with the rules and mitigate risk.

What this means for lawyers, compliance bods, and the M&A teams is that when choosing a data room, they should be looking for one that can tick the right boxes. You need a platform that genuinely addresses data security concerns:

- regulatory compliance features

- robust encryption

- data localization on Indian servers

- comprehensive audit trails showing exactly who accessed what

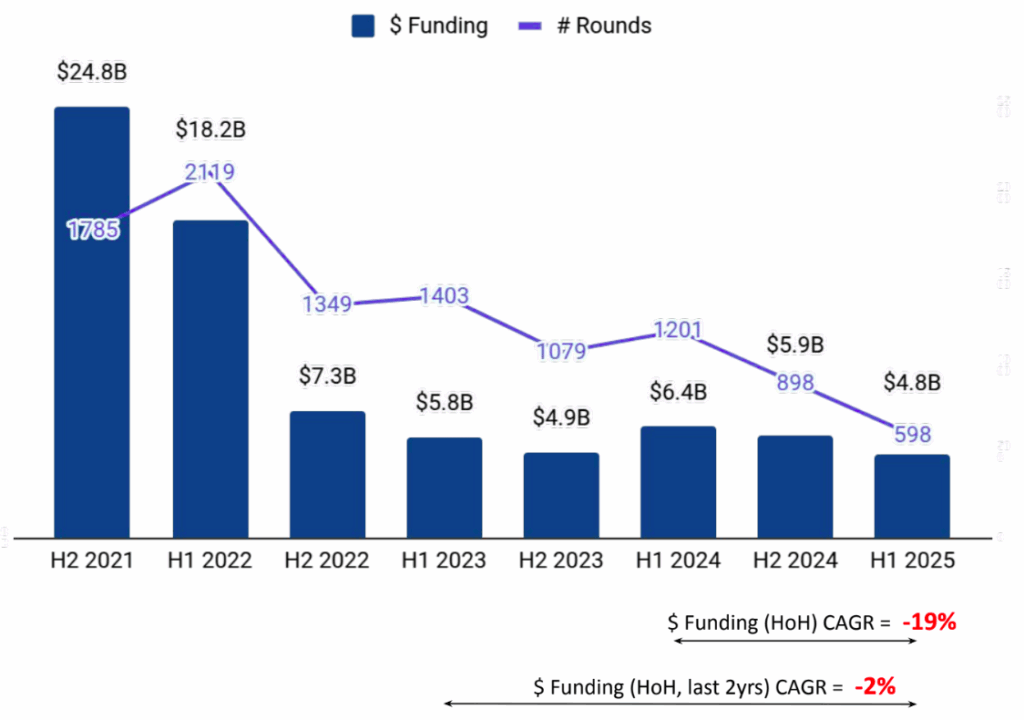

5. Startup ecosystem growth

India’s startup ecosystem and the country ranked #3 globally for technology startup funding in H1 2025, with over $4.8 billion raised. Even though the funding flow was a bit slower compared to the last year (in 2024, Indian startups raised $6.4 billion in the same period), they’ve managed to overtake Germany and Israel. While the US and the UK were still way ahead, it was a pretty impressive showing.

The startups that are scaling fast and getting ready for funding rounds or exits are going to need secure document rooms and some way to control document views and interactions, just to keep everything above board. That’s where virtual data rooms for startups come into play.

6. Cost pressures and shift from physical to virtual

Many Indian companies are under cost pressure with remote teams and higher scrutiny on ROI. The physical data-room model (paper stacks, travel, manual indexing) is no longer viable.

Consider the costs of a typical M&A deal or audit using a physical setup:

- renting secure office space

- printing thousands of pages

- covering travel for all parties

This can easily cost ₹8-12 lakhs or more, not to mention the weeks of preparation time.

In this context, the shift from physical to virtual data rooms is a straightforward financial decision. The same process can be managed for a fraction of the price, often under ₹3 lakhs. Setup takes hours, not weeks. A VDR provides scalable access for users across different cities or countries without extra cost.

7. Cybersecurity awareness & Rising threats

India’s cybersecurity ecosystem is valued at $20 billion as of late 2025, and it is powered by over 400 startups and 650,000 professionals. Companies that handle sensitive deal-documents, such as investor data and board-level info, cannot risk leaks or mis-sharing.

In this market, a VDR that offers encryption, watermarking, audit-trails, and granular permissions becomes nearly essential. Plus, when decision-makers see that the cost of a data-breach (financial, reputational, regulatory) outweighs the investment in a secure data room, they are more likely to adopt this type of software.

VDR market growth projections in India

In its virtual data room market report, Fortune Business Insights valued its global market size at approximately $3.40 billion (2025). At the same time, The Business Research Company estimates the virtual data room market size to be around $3.02 billion as of 2025.

Despite the valuation discrepancies, it is evident that the virtual data room industry is expected to grow significantly. The main growth factors are increased global M&A activity and rising security requirements. And the shift to remote work and cross-border collaborations also drive the adoption of efficient data management solutions.

Taking these factors into account, the VDR market India represents is also on a strong growth trajectory. In 2024, the market was estimated at around $101.5 million, and it is expected to grow at a CAGR of approximately 27–28% between 2025 and 2030.

Several sectors are expected to drive this growth during the forecast period:

- IT and tech companies

- BFSI firms (banking, financial services, and insurance)

- Healthcare and pharmaceuticals

- Manufacturing and e-commerce companies

- Real estate and infrastructure projects

It is worth noting that virtual data room adoption patterns vary by company size. Large enterprises remain the biggest adopters. This is obvious, as they participate in complex deals and need to comply with multiple regulations.

At the same time, mid-market firms begin to adopt virtual data rooms as they expand and embrace digital workflows. SMEs and startups, in their turn, are historically slower to adopt. However, they are now exploring cost-effective VDR solutions to support fundraising, investor due diligence, and other business functions.

The takeaway is clear: India’s virtual data room market is growing faster than the global average. This significant growth creates a window of opportunity for enterprises to adopt early and for vendors to expand their footprint. Choosing the right virtual data room software now, the one that fits your sector and compliance requirements, can be a competitive advantage.

Emerging trends shaping the virtual data room market

The virtual data room market in India is evolving from “simple secure file-sharing for big deals” into an ecosystem of intelligent and compliant platforms accessible for businesses of all sizes. Here are the key data room market trends that shape this evolution:

1. AI & Automation

Nobody wants to spend weeks manually sorting thousands of documents into folders. That’s why AI and machine learning are becoming game-changers in modern virtual data rooms. These tools can read your uploaded files and automatically figure out what they are: contracts go here, financials go there, HR documents somewhere else.

Take V7 Go’s “AI Virtual Data Room Agent,” for example. It claims to speed up setup time by doing all that tedious classification work automatically. In India, where M&A deals and startup fundraising rounds move fast, this matters. Faster document processing means deals close quicker and cost less.

2. Blockchain integration & Immutable audit trails

Yes, blockchain might sound like just another buzzword to grab your attention, but it actually has a real use for virtual data rooms. It can create a secure record that shows exactly who accessed a document, when they did it, and what actions they took, and no one can change that record later.

In M&A deals or cross-border transactions, this kind of ironclad documentation builds trust with all participants (investors, lawyers, and regulators). While fully blockchain-powered virtual data rooms are still emerging in India, Confiex is already talking about “blockchain-enabled trust mechanisms” in its upcoming features.

3. Enhanced security: Encryption, zero-trust & IRM

Concerns of data security in India have never been more pressing, as the number of financial transactions is only growing. The average cost of a data breach hit around ₹179 million in 2023. That’s why businesses look for virtual data room platforms that offer more than just data storage.

We’re talking multi-layer encryption, zero-trust architecture (where everyone gets verified before accessing anything), persistent Information Rights Management, and real-time authentication. These features have become a necessity in the current business landscape.

Confiex Data Room, for example, runs on MEITY-approved data centers in India and uses persistent IRM with real-time authentication. This level of secure data sharing is a requirement rather than just a nice-to-have for many companies out there.

4. Mobile accessibility & Remote collaboration

Remote and hybrid work are the new norm, and virtual data rooms need to adjust to this new landscape. These solutions need to work seamlessly on phones and tablets, not just laptops.

For Indian companies dealing with teams spread across Mumbai, Bangalore, Delhi, and everywhere in between, mobile access is how work gets done. Global platforms are racing to make their VDRs as mobile-friendly as possible. Indian companies take this factor into account when choosing a VDR provider. Local virtual data room companies such as Right2Data and Confiex are also available on smartphones and tablets.

5. Integration with business tools (CRM, ERP, Accounting)

Modern businesses don’t want isolated tools that don’t talk to each other. They want systems that work together. That’s why VDRs are increasingly connecting with CRM platforms (to track investor activity), ERP systems (for document workflows), and accounting software.

For Indian mid-market companies going digital, having a virtual data room technology that integrates with their existing tools means less friction, less wasted time, and lower costs. Indian companies are looking for VDR solutions specifically designed to plug into enterprise systems that businesses already use.

6. Affordable VDR solutions targeting Indian SMEs

Virtual data room market studies show increasing VDR adoption among small and medium enterprises. This happens not because these companies suddenly got richer, but because VDRs finally got affordable.

Traditionally, VDRs used to be only for big corporations with big budgets. A startup raising its Series A or a mid-sized manufacturer looking to sell couldn’t justify the cost.

That’s changing fast. Cloud-based virtual data room providers are rolling out tiered pricing and lighter feature sets aimed squarely at India’s booming startup and SME ecosystem.

7. Regional data residency & Data localization

In India, data localization is increasingly a legal requirement. The Digital Personal Data Protection Act (DPDP Act) and other regulations mean many companies must keep sensitive data on Indian soil.

This has sparked a data center construction boom in India. For VDR buyers, especially in financial services, government, and regulated industries, the question “Where are your servers located?” can be a dealbreaker.

The Confiex-DocullyVDR partnership specifically highlights “MEITY-approved data hosting in India” to guarantee data sovereignty. For companies that can’t risk compliance issues, this local hosting is a major competitive advantage.

Sector-specific opportunities

Not all industries use virtual data rooms the same way, and they shouldn’t. Each sector chases unique opportunities that a good virtual data room can offer. Let’s explore these opportunities in more detail.

| Sector | Key pain points | Current VDR adoption | Growth potential (2025-2030) |

| IT & Technology | Protecting IP during M&A dealsManaging global collaborators across time zonesFast-paced transactions requiring quick document accessCode audits and security reviews with multiple partiesCross-border partnership documentation | Moderate to high | Very high: Indian tech M&A activity acceleratingSaaS companies scaling globallyIP-heavy deals increasingIntegration with dev tools driving adoption |

| BFSI (Banking, Financial Services & Insurance) | Extreme regulatory burden (RBI compliance, audit trails) Managing multiple stakeholders (banks, regulators, investors)High documentation volumes in lending and syndicationIPO and M&A transparency requirementsData breach risks with severe penalties | High | High:Digital banking expansion continuesFintech deals multiplying Stricter data protection laws comingNBFCs increasingly adopting VDRsCross-border investment growing |

| Healthcare & Pharmaceuticals | Extremely sensitive patient data requiring HIPAA-level protectionClinical trial documentation and regulatory filingsDrug approval paperwork across jurisdictionsLicensing deals with global partnersIP protection for pharmaceutical research | Low to Moderate | Very high:Telemedicine boom creating documentation needsDigital health records expandingPharma M&A activity increasingRegulatory scrutiny intensifyingEarly-mover advantage available |

| Manufacturing & E-commerce | Complex supply chain contract managementVendor vetting and onboarding documentationCross-border logistics and regulatory filingPlant acquisitions and joint venture dealsIP protection for manufacturing processesInternational partner collaboration | Low | High:”Make in India” driving international partnershipsE-commerce logistics scaling rapidlySupply chain transparency demands growingContract-heavy environments need better toolsVendor audit requirements increasing |

| Real Estate & Infrastructure | Massive documentation (blueprints, permits, financing data)Multiple stakeholders (developers, financiers, contractors, regulators)Version control nightmares across partiesBid submission security and transparencyCross-border financing documentationEnvironmental clearance tracking | Low to Moderate | Very high:Infrastructure investment surgingCross-border project financing growingLarge untapped market potentialREITs requiring better documentationGovernment project transparency mandates |

Each of these sectors is shaping the VDR market India is building in different ways. The common ground between all of them is that common thread through:

- deal activity increases

- regulations are getting more serious

- secure and transparent document workflows

For decision‑makers, the key is to pick a VDR provider that understands your sector’s specific pain‑points (IP in tech, compliance in BFSI, regulatory in healthcare, global supply‑chain in manufacturing, project‑finance in real‑estate) rather than go for a general-purposed option.

Challenges & Barriers of virtual data room adoption

The Indian VDR market has huge potential, but there are several obstacles that slow down the adoption of secure data management solutions. If you’re a vendor, investor, or decision-maker, you need to understand what you’re up against.

1. High initial implementation costs for SMEs:

- Small and mid-sized companies look at VDR pricing and can’t justify the expense.

- Even affordable cloud-based platforms add up fast once you factor in user licenses, storage, and the features you actually need.

- SMEs either put off adoption completely or buy simple versions that don’t solve their problems.

- Tiered pricing and pay-as-you-go models are not common enough yet.

2. Limited awareness among smaller enterprises:

- Unlike large enterprises and VC-backed startups , smaller businesses are not aware of VDR software.

- Many businesses still use emails and Google Drive to store and share sensitive files, or keep physical documents in locked cabinets.

- Building a great product isn’t enough. Vendors need to actively educate the market.

3. Data localization & sovereignty concerns:

- India’s DPDP Act legally requires sensitive data to stay on Indian servers in many cases.

- International cloud providers and even local startups struggle with complex deployment and compliance

- Companies hesitate to adopt VDRs hosted offshore. They’re waiting for guaranteed India-based hosting.

- Until local hosting becomes standard, adoption in regulated sectors stays slow.

4. Preference for traditional methods in conservative industries:

- Traditional manufacturers and family businesses stick with physical file sharing and face-to-face reviews.

- Changing old habits and workflows takes more than a feature demo.

- Change management and sector-specific success stories work better than pushing technology benefits.

5. Integration challenges with legacy systems:

- Getting VDRs to work with legacy platforms often requires custom connectors or API development.

- Integration challenges delay rollouts, frustrate IT teams, and lead to half-hearted adoption.

- Partial adoption damages ROI. People use the VDR for some things but fall back on old methods for others.

6. Skills gap in managing VDR solutions

- Setting granular permissions, managing user access, and configuring workflows properly requires training.

- Many Indian companies don’t have staff who know how to operate VDRs effectively.

- Mismanagement leads to data leaks, project delays, and wasted features.

- Poor VDR management can also cause reputational damage or regulatory violations.

7. Competition from free or low-cost alternatives

- Someone suggests a proper VDR, someone else says “We already have Google Drive — it’s free.”

- Free cloud storage and email workflows don’t offer audit logs, granular permissions, or compliance features.

- When budgets are tight, “free” looks tempting even when it’s not actually secure.

- VDR providers have to prove they’re not just better, they’re obviously better in ways the budget holder cares about.

Virtual data room market: Investment & Opportunity outlook

The Indian virtual data room market is growing and attracting serious attention from investors who see the opportunities in this sector. Here’s where the money is flowing and what opportunities are emerging:

VCs and PE firms take a closer look at VDRs

Venture capital and private equity investors take a closer look at India-specific solutions. They explore tools that address local pain points like data localization, regional language support, and SME-friendly pricing.

What’s interesting is that investors aren’t just looking at pure-play VDR startups. They’re also watching adjacent spaces, document management platforms, compliance tech, workflow automation tools, software for confidential data exchange, and other tools that could pivot into or integrate with VDR functionality.

Indian vendors could go global

Here’s a narrative that doesn’t get enough attention: Indian VDR vendors have a legitimate shot at competing globally, not just locally.

They’re looking at solutions that solve problems international markets will eventually face:

- Data localization requirements

- Affordable, cloud-native architectures

- Integration with diverse tech stacks and multilingual support

Companies like Confiex Data Room and DocullyVDR are already positioning themselves not just as “India solutions” but as platforms that understand emerging market needs better than legacy Western providers. If they can nail local product-market fit, there’s no reason they can’t expand to Southeast Asia, the Middle East, Africa, and beyond.

Global players see acquisition opportunities

The key players in the virtual data room market, such as Intralinks, Datasite, and DealRoom, are watching the Indian market closely, and some are already entering the local market. But building from scratch in India is hard. The regulatory environment is complex and customer expectations are different. Plus, earning trust in such a competitive landscape takes time.

That creates acquisition opportunities. If you’re a global VDR provider looking to crack the Indian market quickly, buying an established Indian vendor with local expertise might be smarter than trying to build it yourself.

We’re likely to see consolidation play out in two ways: global giants acquiring promising Indian startups to gain market access, and larger Indian players buying smaller competitors to consolidate market share before international competition intensifies. For Indian VDR founders, this means there’s potentially a lucrative exit path beyond just building a sustainable SaaS business.

Government and corporate digital budgets are opening up

The Indian government is pouring money into digital governance initiatives and cybersecurity infrastructure. Corporations, meanwhile, are dedicating larger portions of their IT budgets to cloud migration and collaboration platforms.

VDRs sit right at the intersection of these priorities. They’re cloud infrastructure. They’re compliance tools. They’re collaboration platforms. As the government starts buying more digital tools and companies spend more on technology, VDR providers that understand how to work with public tenders and can clearly show how their platforms help with compliance will have the best chance to win new business and grow their market share.

Public sector adoption is particularly interesting. Government departments handling sensitive projects, infrastructure development, defense procurement, and public-private partnerships need secure document management. If VDR vendors can crack this market, the revenue potential is enormous and sticky.

ROI potential for businesses investing in VDR solutions

For businesses evaluating whether to invest in VDR solutions, the ROI case is actually pretty straightforward once you run the numbers. Consider what VDRs replace:

- traditional physical data rooms (expensive and slow)

- email-based document sharing (risky and unauditable)

- travel costs for in-person due diligence (time-consuming and carbon-intensive)

- the potential cost of data breaches (catastrophic)

Companies using VDRs report faster deal closures, sometimes cutting due diligence timelines by ~23% and more. They avoid compliance penalties from poor document management. They reduce legal and administrative overhead. And critically, they sleep better at night knowing their sensitive data isn’t floating around in unencrypted email attachments.

For a mid-sized company executing even two or three significant transactions a year, the ROI often pays back within months, not years. For enterprises doing frequent M&A or fundraising, it’s a no-brainer.

The challenge here is to get those companies to actually calculate the ROI instead of just looking at the software sticker price.

Market consolidation is coming

Right now, the VDR market in India is fragmented. There are global players with local operations, homegrown startups, and mid-sized providers all competing. That won’t last.

As the market matures, we’ll see consolidation driven by several forces:

- Larger providers can afford better security infrastructure, more robust customer support, and aggressive feature development. Small players will struggle to keep up.

- Customer preference shifts toward established players. As VDR adoption moves beyond early adopters into mainstream enterprises, buyers will favor vendors with proven track records and strong compliance credentials.

- Technology becomes table stakes. AI-powered features, deep integrations, mobile excellence — these require serious R&D investment. Only well-funded companies can maintain the pace.

- Exit pressures mount. Early-stage VDR startups that raised venture capital will face pressure to either scale dramatically or find buyers. Not everyone will make it to the next funding round.

Conclusion: What will happen during the forecast period?

The years between 2025 and 2030 will be a defining chapter for the VDR market India builds. Early adopters are already seeing the payoff: deals close faster, global partners take them more seriously, and their data security is actually locked down. As things evolve, the real strategic advantage will go to companies that pick their VDR partner carefully.

For investors, it’s about finding vendors with real differentiation, not just another “me too” product, but solutions that tackle India-specific challenges better than anyone else out there.

We’ll probably see 3-5 dominant players rise to the top over the next five years, with smaller specialized providers carving out specific verticals or regions. The companies that win will be the ones who scale smartly and lock in customer relationships before everyone else consolidates.